From an on-chain perspective, the bulls appear to be firmly in control of the Bitcoin markets in November so far. If the miners keep accumulating, the BTC price is like to reclaim the $40,000 in the weeks ahead.

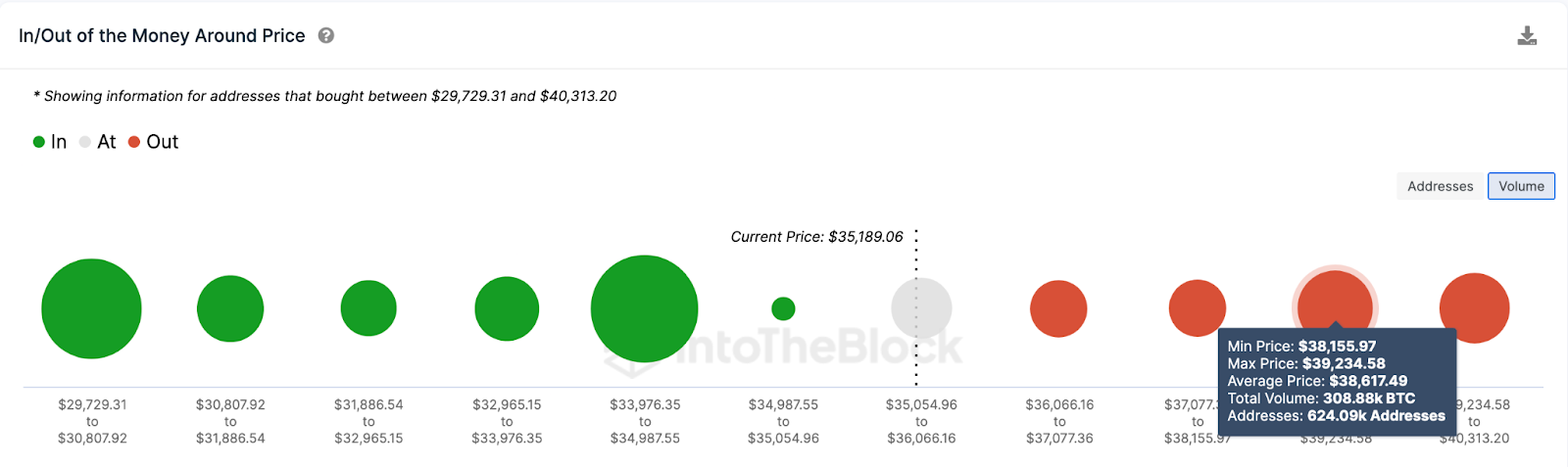

The Global In/Out of the Money (GIOM) data, which groups the current BTC holders according to their entry prices, also confirms this bullish forecast.

It shows that BTC must scale the $38,600 resistance for the bulls to be confident of flipping $40,000. As depicted below, 624,090 holders had bought 309,880 BTC at an average price of $38,612. If those holders sell early, they could slow down the rally significantly.

But if that resistance level caves, Bitcoin price will likely reclaim $40,000 as predicted.

On the downside, the bears could negate the optimistic prediction if the BTC price reverses below $33,000.

But, in that case, the 2 million BTC holders who bought 604,200 BTC at the minimum price of $33,900 will mount a support wall. If those investors can HODL, BTC price will likely defend the $34,000 territory and prevent a significant bearish reversal.