Collections to be utilized exclusively for developmental activities in respective Municipalities

In a meeting chaired by the Chief Secretary to deliberate upon misinformation created regarding property tax in Jammu and Kashmir, it was clarified that all the poor, marginalized having small houses having built-up area up to 1000 square feet have been exempted by the government from paying any property tax to be levied from April onwards this year.

The meeting was attended by Additional Chief Secretary, Home; Principal Secretary, H&UDD; ADGP Jammu/Kashmir; Deputy Commissioners; SSPs; Commissioners of Jammu and Srinagar Municipal Corporations and other concerned officers.

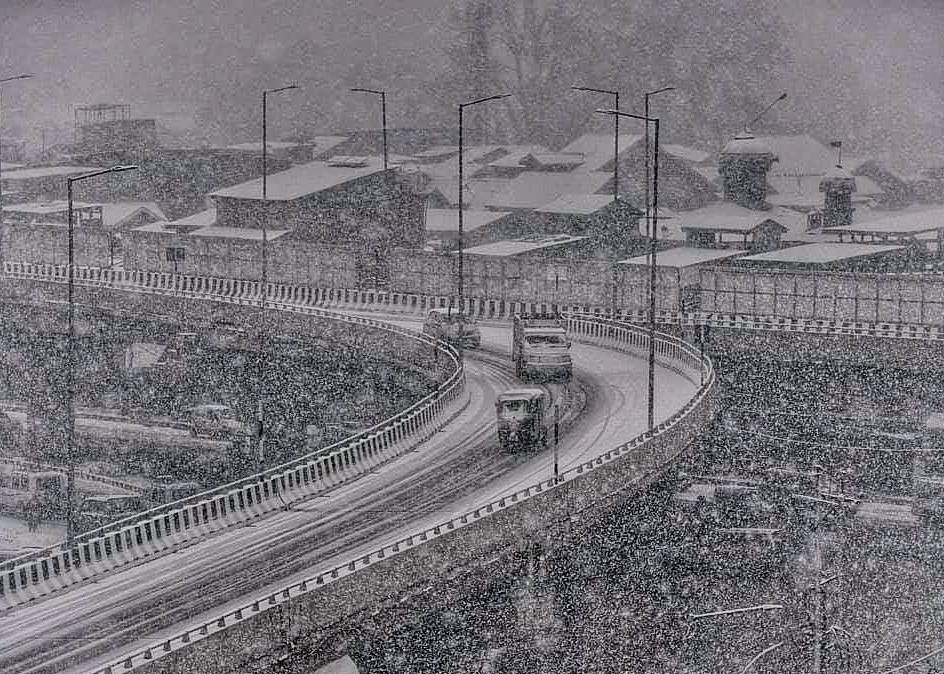

Also Read: JKDMA issues avalanche warning for four districts

It was informed that levy of property tax is essential part of urban sector reforms. Jammu and Kashmir is one of the last States/UTs to levy property tax and non-imposition of the tax was depriving local bodies to become self sustaining. Urban Local Bodies (ULBs) are required to render multiple civic services in their jurisdiction and need resources. The levy of this tax will improve the financial health of these institutions and improve services, besides creating employment.

While explaining the methodology of levying this tax in the UT, the Principal Secretary, H&UDD, Rajesh Prasad stated that there is no tax liability for those having built-up area of their houses less than 1000 sft besides the proportion of taxes is considerably lesser here than that levied in other parts of the country. Similarly, all places of worship, including Temples, Masjids, Gurudwaras, Churches, Ziarats, Cremation grounds, Burial grounds etc are exempt from payment of property tax.

It was further informed that the Tax is proposed to be levied at just 5% of Taxable Annual Value (TAV) of the property in case of a residential property and at 6% of TAV in case of Non-Residential property. It was also apprised that the tax rates, even in the Corporations are one of the lowest in the country, almost half that of Himachal, and one fourth to one sixth, overall, of other progressive States like Gujarat Maharashtra, Karnataka and Delhi. Tax to be paid in Municipal Committees shall be much lower than that of Municipal Corporations. There is no property tax in rural areas. Besides the property tax is to be assessed and paid on annual basis.

Elucidating further the Commissioner, Jammu Municipal Corporation, Rahul Yadav informed that the tax is progressive in nature with low tax on smaller assets and is linked to circle rates – lower the circle rate, lower is the tax liability of the owner. The tax also takes into account factors like age of the property, usage type and construction type etc to arrive on TAV for realistic capturing of value of property.

Cases illustrating such as property tax to be levied on a 35 year old residential house with built up area of 4500 Sft in Gandhi Nagar is assessed to be Rs.5758 for one year. Similarly, a 25 year old residential house in Sarwal with built up area of 2000 Sft will have to pay only Rs1063 as property tax. A 5 year old residential house with built up area of 3500 Sft in Channi area would be assessed to Rs5374 property tax for one year.Small shops shall have to pay very small amounts with the example of a small shop in the old city area of Jammu with area of about 200 Sft which is only 0-20 years oldwould be liable to pay tax of only Rs 838 per annum.

In this regard Dr Mehta directed the DCs to create awareness in their areas by giving such real examples of calculation of the tax for different properties in their ULBs of the district. He observed that the misinformation created among people should be addressed by taking them along. He asked them to involve the elected representatives and civil society members in dissemination of the information and actual objectives of imposing this tax here.

Also Read: Teacher bites teachers’ ear in an in-house quarrel in Pattan

On the occasion the Chief Secretary also impressed upon the officers to create awareness among public for removing misconceptions. He told them to create a helpline for the masses which would disseminate the correct information about this matter. He urged them to come up with a simple ‘Property Tax calculator’ for people so that they themselves are able to assess the actual amount they are liable to pay.

It was also mentioned that economy of J&K has been doing well and unemployment rate as per GoI data has shown healthier trend. The per capita income of people of J&K is amongst better States/UTs.

Dr. Mehta emphasised on the fact that people should be made aware that it is not permitted to direct ULB resources for any other purposes. The property tax paid by people shall be used in their own areas. The accumulations of the tax money will be collected by the ULBs, retained by them and used for their development needs exclusively. The tax to be collected from the people shall be spent only for their betterment, improving their quality of life.

Regarding its implications it was said that the Property Tax is to be levied annually and can be paid in two equal installment. Further, 10% rebate can be availed by early payment of the Property Tax.

The payment of property tax shall also facilitate common people in availing various facilities and services through their concerned local bodies with the expenditure of funds collected by levying this tax.